Unlocking the ESG premium: How to capitalise on green investment

A decade ago, conversations about ESG (environmental, social, governance) weren’t nearly as pervasive as they are now. In fact, since 2009, attitudes towards ESG have changed significantly, as a recent McKinsey report reveals. And while a new report by EY recently revealed growing concerns about the lack of clarity and visibility within ESG disclosures, investors and business leaders still value ESG performance more than ever.

In this article, we’ll explore why changing beliefs about ESG means that strong performance on environmental, social and governance factors can no longer be simply a fringe goal for manufacturers, and how smart manufacturers can capitalise on the ESG premium.

What is the ESG premium?

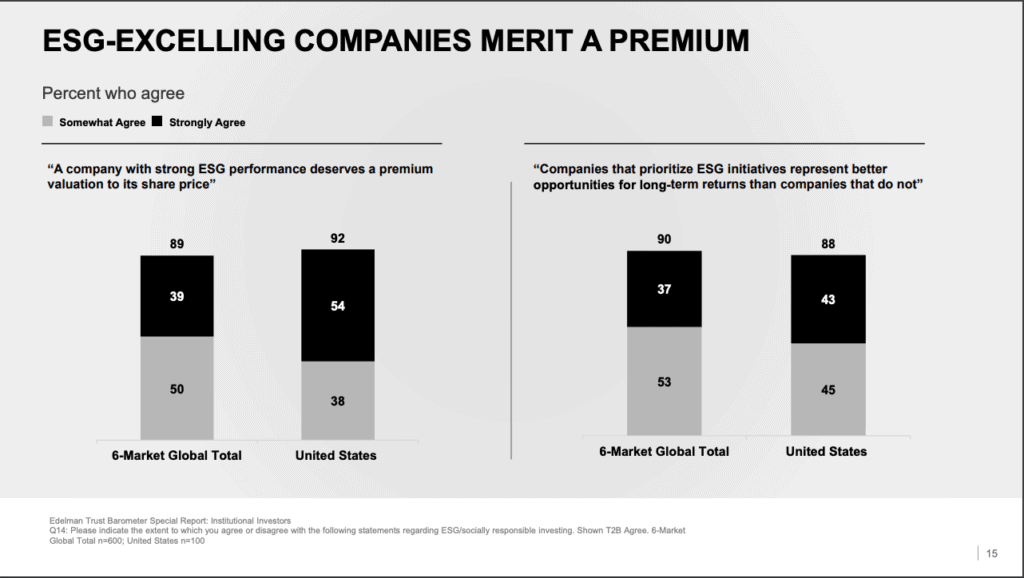

From an investment perspective, companies are increasingly being valued not just on their financial performance, but also on their ESG performance. A study by McKinsey revealed that 25% of executives and investors would pay a 20-50% premium to acquire a company with a positive ESG record, and even those who believe ESG has no effect on shareholder value would still pay a 10% premium for strong ESG companies.

Data abounds to prove this point. 89% of institutional investors believe companies with high ESG scores deserve premium share price valuation; 91% consider non-financial performance as critical in investment decisions, and 90% agree that prioritising ESG leads to better long-term returns.

But where did the ESG premium come from? Increasingly, environment and human-rights-related concerns are considered significant financial risks for businesses. For example, a company that relies on large sources of water in a drought-prone area is exposed to high risk if a drought arises.

Secondly, conscious consumerism and rising expectations of corporate responsibility have led to the popularity of ESG funds, with investors evaluating companies on the basis of how well they align with their own moral interests. So while ESG issues put companies at risk, positive ESG performance opens doors for new opportunities.

The financial relevance of ESG

Too often, ESG is mistaken for a corporate goodwill or employee engagement initiative (much like its predecessor and contemporary, CSR). But in today’s corporate climate, investment professionals largely agree that ESG programs affect performance — it all comes down to how you communicate its financial relevance.

It’s helpful to have finance teams directly involved in ESG reporting and strategy, so that ESG efforts become closely aligned with financial planning and strategic and operational decisions. Improving financial relevance might also involve expanding disclosures to better convey impact; a 2021 EY report suggests the term FESG to refer to financially relevant ESG factors, and FESG+ to refer to a broader range of future disclosures, including topics such as biodiversity, innovation, and wellbeing. Ultimately, communicating the financial relevance of your ESG strategy will allow for more meaningful change across your organisation.

Why is ESG valued so highly by leaders?

ESG improves a company’s valuation and financial performance in multiple ways.

It allows businesses to maintain a good corporate reputation, helps to attract and retain talent, strengthen a company’s standing in the market, results in more shareholder value, and acts as a proxy for good management.

68% of consumers believe the private sector should be responsible for driving positive social and environmental outcomes, and the more transparent a company can be about its ESG considerations, the more it inspires trust among investors and stakeholders.

Additionally, investments in sustainable infrastructure and practices are increasingly becoming the cost-saving, higher-ROI alternative, particularly when calculated over the long-term. For the companies that get ESG right, the rewards are clear. But how can manufacturers take advantage of the ESG premium?

How manufacturers can unlock the ESG premium

Unfortunately, unlocking the ESG premium is not as easy as flipping a switch. But with the right guidance and resources, any company, large or small, can reap the benefits.

Understanding stakeholder demands

Before you set targets and design strategies, conduct interviews and surveys to find out what each of your various stakeholders (including internal stakeholders) want and expect from your ESG programs. This can be performed as part of a materiality assessment, a crucial first step in any ESG journey.

Do your research and take upcoming regulatory changes into account. For example, UK companies might read up on the pending ‘green taxonomy’.

And finally, research popular ESG frameworks and standards and work out the best framework (or combination of frameworks) for your company and industry. Following a clear framework will make reporting and goal-setting more straightforward, and McKinsey’s research shows that executors and investors find frameworks helpful for valuing ESG programs.

Get everyone on board

Recruiting your entire organisation’s support for your ESG efforts is both a vertical and horizontal process. Communicating the importance of ESG to higher-ups and C-suite leaders is most effective through the context of long-term value. Don’t just show them the opportunities that await — remind them of what they risk missing out on if they don’t take action. (Use the above data on ESG premiums, if you need to).

Get good data

Comprehensive benchmarking is crucial to ESG programs, and both benchmarking and reporting require significant amounts of accurate, verifiable and auditable data. Managing and verifying the enormous quantities of data required for ESG reporting can quickly take up much of your team’s time, so it’s important to get the right tools in place to help with collecting and managing meaningful ESG data, and reducing friction at reporting time.

Work with experts

Working with subject matter experts can help your team connect the dots between data points and the actions they result in, ensuring that the information driving your decision-making is airtight. ESG experts are in high demand, and it’s worth considering whether you’ve got capacity to bring talent in-house, or whether you’ll start your journey by working with external partners. Whichever you decide, getting the right expertise is critical to your ESG success.

Embed ESG across the organisation

The only way to run a truly effective ESG program is to integrate ESG goals and tactics into decision-making processes in every department and at every level of your organisation. ESG is far more effective when embedded throughout, rather than contained as a ‘fringe’ goal within a separate team.

For best integration results, find ways to align ESG targets with core company values, or consider adapting your values to make room for ESG-related topics. Make sure your ESG goals and strategies make sense in the context of your other corporate and business goals. For example, don’t initiate a travel freeze right before a corporate retreat — make sure it all adds up!

Get other teams and departments aligned with your ESG plans by recruiting their help in achieving or communicating your targets. For example:

- Work collaboratively with marketing and PR to embed your ESG story into your broader brand narrative and campaigns

- Ask legal for help reducing your risk of greenwashing through your sustainability claims

- Work with HR to set up employee visits to offsetting projects

It’s time to act on ESG

The time to act on ESG is now. With considerable risk posed to companies who ignore ESG, and a significant premium available for those who do, manufacturers simply can’t afford to miss out on the benefits of a robust ESG program.

To see what other benefits exist for businesses who embed things like climate action into their core strategies, check out this guide.